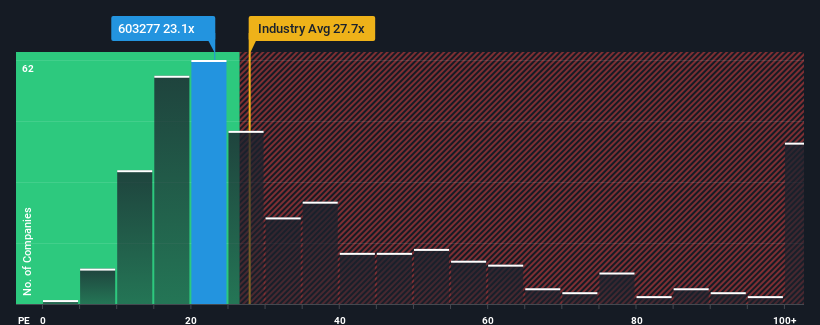

Yindu Kitchen Equipment Co., Ltd. (SHSE:603277) has a price-to-earnings ratio (or “P/E”) of 23.1x, which may make it look like a buy at the moment when compared to the Chinese market, where roughly half of the companies have P/E ratios above 30x and it's not uncommon to see P/E ratios above 55x. However, it would be unwise to take the P/E at face value, as this may explain why the P/E is limited.

Recent times have been good for Yindu Kitchen Equipment, with the company's earnings growing faster than most other companies. One possibility is that investors believe this strong earnings track record won't be as impressive going forward, which is why the price-to-earnings multiple is low. If this isn't the case, existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Yindu Kitchen Equipment

Want a complete look at what analysts are forecasting for the company? free A report on Yindu Kitchen Equipment will help you know what the future holds.

Is the growth worth the low P/E?

Yindu Kitchen Equipment's P/E ratio is typical for a company that is expected to only have limited growth and, importantly, underperform the market.

Looking back at revenue growth over the last year, the company recorded an impressive increase of 34%. What's pleasing is that EPS has also grown over the past 12 months, bringing it up a total of 60% compared to three years ago. So, we can start by noting that the company has made a strong contribution to revenue growth over this period.

Looking ahead, the three analysts who follow the company expect EPS to grow 17% annually over the next three years, which is likely to be significantly lower than the overall market forecast of 25% annual growth.

With this in mind, it's understandable that Yindu Kitchen Equipment's P/E is lower than the majority of other companies – apparently many shareholders were uncomfortable holding on to shares while the company looked towards a less-than-prosperous future.

Key Takeaways

Generally, we like to limit the use of price-to-earnings ratios to revealing what the market thinks about the overall health of a company.

As expected, a look at analyst forecasts for Yindu Kitchen Equipment reveals that the company's poor earnings outlook is contributing to its low P/E ratio. At the moment, investors feel that the potential for earnings improvement is not great enough to justify an increase in the P/E ratio. Unless these conditions improve, the stock will likely continue to be a barrier around these levels.

Additionally, you should also know this 1 warning sign we spotted for Yindu Kitchen Equipment.

Interested in the P/E ratio?you might want to take a look at this free A collection of other companies with high earnings growth and low P/E ratios.

Valuation is complicated, but we can help make it simple.

investigate Yindu Kitchen Equipment By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.