Many investors, especially inexperienced investors, typically buy stocks in companies with a good story, even if the company is losing money. In some cases, these stories can cloud investors' minds and lead them to invest based on their emotions rather than the merits of a good company's fundamentals. Because loss-making companies are always in a race against time to achieve financial sustainability, investors in these companies may be taking on more risk than necessary.

So if this idea of high risk and high reward doesn't suit you, you might be more interested in profitable growth companies such as: Ginto kitchen equipment (SHSE:603277). Profit is not the only metric to consider when investing, but it is worth evaluating companies that can consistently generate profits.

Check out the latest analysis of Ginto Kitchen Equipment.

Ginto Kitchen Equipment's earnings per share are increasing

Generally, if a company is growing its earnings per share (EPS), the share price should follow a similar trend. Therefore, it makes sense for experienced investors to pay close attention to a company's EPS when doing investment research. We can see that over the past three years, Ginto Kitchen Equipment's EPS grew by 15% per year. This is a pretty good rate if the company can maintain it.

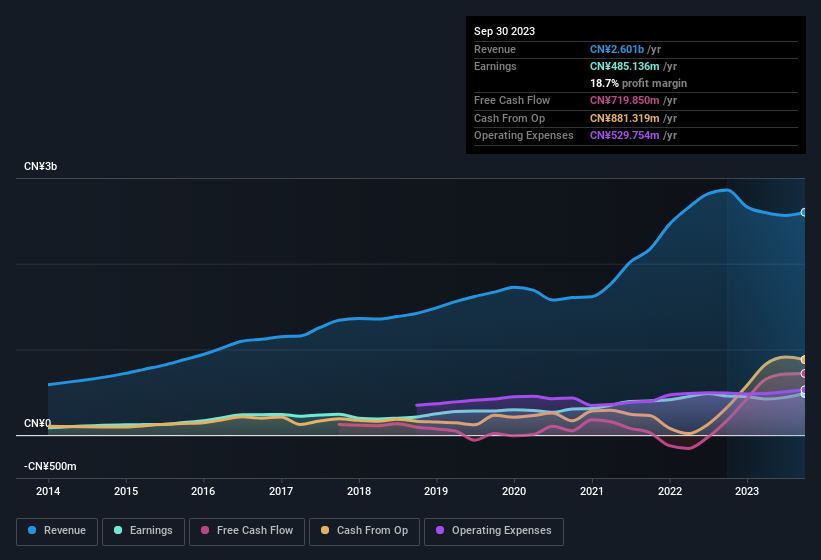

Carefully considering revenue growth and earnings before interest, tax, and tax (EBIT) margins can help inform our view on the sustainability of recent earnings growth. Ginto Kitchen Equipment's EBIT margin is flat, but worryingly, its revenue is actually declining. This doesn't bode well for short-term growth prospects, so it's very important to understand the reasons for such an outcome.

In the graph below, you can see how the company has grown its revenue and revenue over time. Click on the graph to see exact numbers.

In investing, as in life, the future is more important than the past.Why not check this out? free Interactive visualization of yingdu Kitchen Equipment forecast Profit?

Are Ginto Kitchen Equipment insiders working with all shareholders?

Theory suggests that high insider ownership in a company is an encouraging sign, because company performance is directly tied to the financial success of management. So those interested in Ginto Kitchen Equipment will be happy to know that insiders believe they own a majority of the company's shares. To be precise, company insiders own 73% of the company, so their decisions can have a big impact on your investment. Intuitively, this tells us that this is a good sign. Because it suggests they have an incentive to build value for shareholders over the long term. CA$8.6b This level of investment from insiders is nothing to sneeze at.

Are yingdu kitchenware worth putting on your watchlist?

One good thing about Ginto Kitchen Equipment is that EPS is growing. That makes me happy. For those looking for more, the high level of insider ownership fuels our enthusiasm for this growth. The combination is very attractive. Yes, we think this stock is worth watching. While we've considered the quality of earnings, we haven't yet done any work to value the stock. So if you want to buy cheap, you might want to check whether Ginto Kitchen Equipment is trading on a high P/E or a low P/E compared to its industry.

Ginto Kitchen Equipment certainly looks good, but if insiders have been buying up shares, it could become more attractive to more investors. If you want to know which companies have insider buying, check out our curated selection of Chinese companies that not only boast strong growth, but also have recent insider buying.

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we help make it simple.

Please check it out Ginto kitchen equipment Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.